Creating A Will: The Importance Of Estate Planning

Are you prepared for the future? Taking the time to plan your estate and create a will is a crucial step in ensuring your assets and loved ones are protected. Estate planning allows you to have control over who receives your belongings and assets after you pass away, providing peace of mind for you and your family. In this article, we will explore the importance of estate planning and why creating a will is a vital component of securing your legacy. So, let’s dive in and discover how this simple act can have a profound impact on your loved ones and their financial future.

Understanding Estate Planning

What is estate planning?

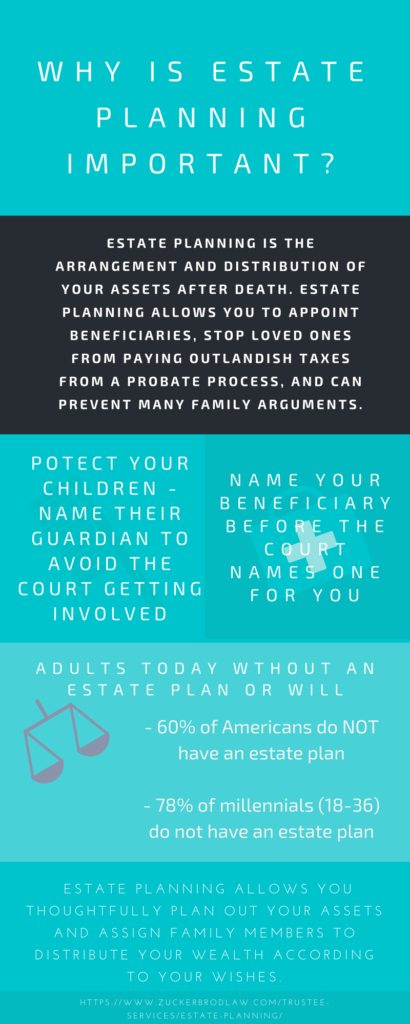

Estate planning is the process of arranging for the management and disposal of your assets upon your death or incapacitation. It involves creating legal documents such as wills, trusts, and powers of attorney to ensure that your wishes are carried out and your loved ones are taken care of after you’re gone.

Why is estate planning important?

Estate planning is important because it allows you to have control over what happens to your assets and who receives them after your death. Without proper estate planning, your assets may be distributed according to state laws, which may not align with your wishes. Additionally, estate planning can help minimize taxes and avoid probate, saving time and costs for your beneficiaries.

Key elements of estate planning

There are several key elements of estate planning that you should consider:

-

Will: A will is a legal document that outlines how your assets will be distributed after your death. It also allows you to name guardians for minor children and appoint an executor to carry out your wishes.

-

Trusts: Trusts are legal arrangements that enable you to transfer assets to a trustee who will manage them on behalf of your beneficiaries. Trusts can provide added protection, control, and flexibility in distributing your assets.

-

Powers of attorney: Powers of attorney designate a person to make financial or healthcare decisions on your behalf if you become unable to do so. This ensures that your affairs are properly handled in the event of incapacity.

-

Beneficiary designations: Certain assets, such as life insurance policies and retirement accounts, allow you to designate beneficiaries who will receive the assets directly upon your death.

The Importance of Creating a Will

What is a will?

A will is a legal document that specifies how you want your assets to be distributed after your death. It allows you to name beneficiaries for your property, appoint guardians for minor children, and designate an executor to carry out your wishes. Creating a will ensures that your assets are distributed according to your wishes and provides clarity and guidance for your loved ones.

Benefits of creating a will

Creating a will offers several benefits:

-

Asset distribution: A will allows you to determine who will receive your assets and in what proportions. Without a will, state laws will dictate how your assets are divided, which may not align with your intentions.

-

Guardianship for minors: If you have minor children, a will allows you to appoint guardians who will be responsible for their care should something happen to you. This provides peace of mind knowing that your children will be taken care of by someone you trust.

-

Executor appointment: By creating a will, you can designate an executor who will be responsible for administering your estate. This person will handle tasks such as paying off debts, filing tax returns, and distributing assets according to your wishes.

-

Minimizing family disputes: A well-drafted will can help minimize disputes among family members by providing clear instructions on asset distribution. This can prevent potential conflicts and ensure that your loved ones are not left grappling with uncertainties.

Who needs a will?

Everyone, regardless of age or wealth, can benefit from having a will. Having a will is especially crucial if you have dependents, own valuable assets, or have specific wishes for asset distribution. By creating a will, you gain control over your assets and ensure that your loved ones are taken care of according to your wishes.

Common misconceptions about creating a will

There are several misconceptions surrounding the creation of a will:

-

“I’m too young to create a will”: Age is not a determining factor for creating a will. Unexpected events can happen at any age, and having a will in place ensures that your wishes are known and followed.

-

“I don’t have enough assets to warrant a will”: A will is not just about distributing assets; it also addresses guardianship for minors and appointing an executor. Regardless of the size of your estate, a will can provide clarity and protection.

-

“My spouse will inherit everything anyway”: While this may be the case in some jurisdictions, having a will ensures that your assets are distributed according to your specific wishes, rather than relying solely on default legal provisions.

-

“I can just write my wishes down and they will be honored”: While documenting your wishes is a good start, a will must meet specific legal requirements to be valid. Consulting with a qualified attorney ensures that your will is properly drafted and legally enforceable.

Determining the Distribution of Assets

Importance of asset distribution

Determining how your assets will be distributed is a critical aspect of estate planning. By specifying your wishes, you can ensure that your assets go to the people or causes that are important to you. Proper asset distribution not only protects your legacy but also minimizes potential disputes among your loved ones.

Choosing beneficiaries

When it comes to asset distribution, you have the flexibility to choose your beneficiaries. Beneficiaries can include family members, friends, charitable organizations, or even specific individuals within a family. It’s important to carefully consider your selections and update your beneficiaries as needed to reflect any changes in personal circumstances or relationships.

Types of assets included in a will

Your will can cover a wide range of assets, including:

-

Real estate: This includes any land, buildings, or homes that you own.

-

Personal property: This encompasses items such as vehicles, jewelry, furniture, art, and other possessions of value.

-

Financial accounts: Bank accounts, investments, retirement accounts, and life insurance policies can be included in your will.

-

Business interests: If you own a business, you can specify how your interests in the company will be handled after your death.

Considerations when distributing assets

Here are some important considerations to keep in mind when distributing your assets:

-

Fairness vs. equality: Your goal may be to distribute your assets fairly among your beneficiaries, rather than equally. Consider their needs, circumstances, and your own intentions in determining the most appropriate distribution.

-

Tax implications: The way assets are distributed can have tax implications for your beneficiaries. Consulting with a tax professional can help you minimize potential tax burdens.

-

Special considerations: If you have minor children or beneficiaries with special needs, you may need to establish trusts or designations that provide specific instructions for managing and distributing assets on their behalf.

-

Charitable giving: If you have a philanthropic spirit, consider including charitable organizations in your asset distribution plan. This allows you to leave a lasting impact and support causes that are important to you.

Appointing an Executor

What is an executor?

An executor is an individual or entity designated in your will to administer your estate after your death. They are responsible for managing your assets, paying off debts and taxes, filing necessary paperwork, and distributing your assets according to your wishes. Choosing the right executor is crucial to ensure that your estate is handled efficiently and in line with your intentions.

Roles and responsibilities of an executor

The roles and responsibilities of an executor include:

-

Gathering and managing assets: The executor is responsible for locating and securing all assets belonging to the estate. This may involve accessing bank accounts, managing investments, and ensuring the proper maintenance of property.

-

Paying off debts and taxes: The executor must identify and pay off any outstanding debts or taxes owed by the deceased. This includes filing the final income tax return and estate tax returns if applicable.

-

Distributing assets: Once debts and taxes have been settled, the executor distributes the remaining assets to the beneficiaries as outlined in the will. They must ensure that the distribution is carried out in accordance with applicable laws.

-

Handling legal matters: The executor is responsible for navigating the legal processes associated with probating the will, such as filing necessary paperwork with the court and providing an accounting of the estate’s assets and distributions.

Selecting the right executor

Choosing the right executor is important to ensure that your estate is managed effectively. Here are some factors to consider when selecting an executor:

-

Trustworthiness: Look for someone you trust to handle your affairs with honesty and integrity.

-

Organizational skills: An executor should possess strong organizational skills to manage financial and legal matters efficiently.

-

Availability: Consider whether the potential executor has the time and availability to fulfill their duties effectively.

-

Financial acumen: Depending on the complexity of your estate, it may be advantageous to choose an executor with some financial knowledge or experience.

-

Objective decision-making: An executor should be capable of making decisions objectively and putting the interests of the beneficiaries first.

Remember to discuss your choice of executor with the individual beforehand to ensure they are willing and able to take on the responsibility.

Guardianship and Care for Minors

Ensuring the well-being of your children

Planning for the well-being of your children is a crucial part of estate planning. In the unfortunate event that both parents pass away or become incapacitated, having a plan in place ensures that your children are cared for by someone you trust and according to your wishes.

Appointing a legal guardian

Through your will, you can appoint a legal guardian for your minor children. A legal guardian is someone who will step in and assume parental responsibilities if you are no longer able to care for your children. Consider the following factors when selecting a guardian:

-

Shared values: Look for someone who shares your values and parenting philosophies, as they will play a significant role in shaping your children’s lives.

-

Relationship with your children: Choose someone who has a preexisting positive relationship with your children and understands their needs.

-

Financial stability: Consider the financial stability of the potential guardian to ensure that they can provide for your children’s basic needs.

-

Location: Think about the potential guardian’s location and whether it aligns with your wishes for your children’s upbringing.

It’s important to have open and honest discussions with the person you wish to appoint as a legal guardian to ensure they are willing to take on the responsibility.

Financial arrangements for minors

In addition to appointing a legal guardian, you may also want to consider setting up financial arrangements for the care of your minor children. This can be done through trusts or custodial accounts. By specifying how funds should be used for their education, health, and general well-being, you can ensure that your children are provided for even in your absence.

Minimizing Estate Taxes

Understanding estate taxes

Estate taxes are taxes imposed by the government on the transfer of a person’s assets after their death. The tax is typically based on the overall value of the estate and can significantly reduce the assets available to your beneficiaries. Understanding estate tax laws and implementing strategies to minimize their impact can help preserve your wealth for future generations.

Strategies to minimize estate taxes

Here are some commonly used strategies for minimizing estate taxes:

-

Gifting: By gifting assets during your lifetime, you can reduce the overall value of your estate subject to estate taxes. The annual gift tax exclusion allows you to gift a certain amount to an individual each year without incurring gift taxes.

-

Tax-Free Gifts: Certain gifts, such as donations to qualified charitable organizations, are exempt from gift and estate taxes. Making charitable donations can both reduce your taxable estate and support causes you care about.

-

Irrevocable Life Insurance Trusts: Placing life insurance policies into an irrevocable life insurance trust can help remove them from your taxable estate. The trust becomes the policy owner, and the insurance proceeds are distributed to your beneficiaries tax-free.

-

Qualified Personal Residence Trusts: A qualified personal residence trust allows you to transfer your primary residence or vacation home to the trust while retaining the right to live in it for a specified period. This reduces the value of your estate and can minimize estate taxes.

The role of trusts in estate planning

Trusts play an important role in estate planning, especially in reducing estate taxes and ensuring the smooth transfer of assets. They offer several benefits, including:

-

Control over asset distribution: By establishing a trust, you can specify how and when your assets will be distributed to your beneficiaries. This allows you to protect assets from creditors or ensure that they are used for specific purposes, such as education.

-

Probate avoidance: Assets held in a trust can pass directly to beneficiaries without going through probate, which can be a time-consuming and costly process.

-

Protection against incapacity: Trusts can also provide for the management of your assets if you become incapacitated. A successor trustee can step in and manage the trust on your behalf, ensuring that your financial affairs are properly handled.

It’s important to work with a qualified estate planning attorney to determine the most appropriate trust structure for your specific needs and goals.

Planning for Incapacity

Importance of planning for incapacity

Planning for incapacity is an essential part of estate planning. Incapacity can arise from various factors, such as illness, injury, or cognitive decline, and can leave you unable to manage your own affairs. By making advanced arrangements, you can ensure that your wishes are honored and avoid potential disputes or financial mismanagement.

Power of attorney

A power of attorney is a legal document that designates an agent to act on your behalf in financial or legal matters if you become incapacitated. The agent, also known as an attorney-in-fact, can handle tasks such as paying bills, managing investments, and making legal decisions.

There are two types of powers of attorney:

-

General power of attorney: This grants broad authority to the agent to act on your behalf in various financial and legal matters. It remains in effect until revocation or your death.

-

Durable power of attorney: A durable power of attorney remains in effect even if you become incapacitated. This ensures that your affairs can still be managed if you are unable to do so yourself.

When choosing an agent, consider someone you trust implicitly, as they will have significant control over your financial and legal matters.

Advanced healthcare directives

Advanced healthcare directives, also known as living wills or healthcare proxies, allow you to specify your medical treatment preferences in the event that you are unable to communicate your wishes. This document outlines the type of medical care you want to receive, or not receive, and appoints a healthcare agent to make medical decisions on your behalf.

These directives provide guidance to healthcare professionals and your loved ones, ensuring that your medical wishes are respected. They can cover a range of decisions, including life-support measures, pain management, and organ donation.

It’s important to discuss your medical preferences with your appointed healthcare agent to ensure they understand your wishes and are prepared to advocate for them.

Updating and Reviewing Your Will

Periodic review of your will

Creating a will is an important first step, but it’s equally crucial to periodically review and update it as needed. Life circumstances, relationships, and asset portfolios can change over time, making it necessary to modify your will to reflect your current wishes accurately.

Reviewing your will should be done every few years or whenever a significant life event occurs. This ensures that your will remains up to date and relevant.

Life events that require updates

Certain life events require immediate updates to your will:

-

Marriage or divorce: When you get married or divorced, it’s important to review and update your will to reflect your new marital status and changes in beneficiaries.

-

Birth or adoption of children: With the arrival of a new child, you may want to update your will to include them as beneficiaries or appoint guardians.

-

Death of a beneficiary or executor: If a beneficiary or executor named in your will passes away, it’s crucial to update your will to reflect this change.

-

Significant change in assets: If you acquire or dispose of significant assets, it may be necessary to update your will to reflect these changes accurately.

It’s always a good idea to consult with a qualified estate planning attorney when making updates to your will to ensure they are executed correctly.

Seeking professional advice for modifications

Modifying your will can be a complex process, and it’s important to seek professional advice when making any changes. An experienced estate planning attorney can help you navigate through the legal requirements and ensure that your modifications are properly implemented.

They will guide you through the process, ensure that your modifications comply with applicable laws, and provide peace of mind that your will accurately reflects your wishes.

Avoiding Disputes and Legal Challenges

Common disputes over wills

Disputes over wills can arise for various reasons and can be emotionally and financially draining for your loved ones. Common reasons for disputes include:

-

Lack of clarity: If your will is poorly drafted or contains ambiguous language, it can lead to confusion and potential disputes among beneficiaries.

-

Capacity concerns: If there are doubts about your mental capacity at the time of executing the will, it may create grounds for a dispute.

-

Undue influence: If there is evidence that someone exerted undue influence over you when creating or modifying your will, it can lead to challenges.

-

Disinherited family members: Disgruntled family members who feel unfairly excluded or treated in your will may initiate legal challenges.

Preventing inheritance disputes

While it’s impossible to guarantee that disputes will not occur, taking certain steps can help minimize the chances:

-

Clearly communicate your intentions: Openly discuss your estate plan with your loved ones to ensure that they understand your decisions and the reasons behind them.

-

Seek professional guidance: Working with an experienced estate planning attorney can help ensure that your will is properly drafted, reducing the chances of disputes based on ambiguity.

-

Review your estate plan regularly: Periodic review of your will can help identify and address potential issues before they become disputes.

-

Consider including a no-contest clause: This clause states that if a beneficiary contests the will and loses, they will forfeit their inheritance. It can serve as a deterrent to unfounded claims.

While these steps can help minimize disputes, it’s important to remember that family dynamics and emotions can sometimes lead to challenges. Seeking professional legal advice can help mitigate the potential impact of disputes and ensure that your wishes are respected.

Legal requirements for a valid will

To ensure that your will is legally valid and enforceable, it must meet certain requirements, which can vary by jurisdiction. Some common legal requirements for a valid will include:

-

Testamentary capacity: At the time of creating a will, you must be of sound mind and understand the nature and consequences of your actions.

-

Intent: Your will must clearly express your intention to distribute your assets upon your death.

-

Signature: Your will must be signed by you in the presence of witnesses who also sign the document. The number of witnesses required may vary by jurisdiction.

-

Witness credibility: Witnesses should be individuals who are not beneficiaries named in your will or related to beneficiaries.

It’s important to consult with an estate planning attorney or legal professional in your jurisdiction to ensure that your will meets all the required legal standards.

Conclusion

Estate planning is a vital process that allows you to protect your assets, ensure the well-being of your loved ones, and leave a lasting legacy. By understanding the importance of creating a will and addressing various components of estate planning, you can take proactive steps to secure your assets and provide peace of mind for yourself and your loved ones. Remember to periodically review and update your estate plan, seek professional guidance when needed, and consider the long-term implications of your decisions. By taking these steps, you can navigate the complexities of estate planning and leave a meaningful legacy for future generations.

Leave a Reply